Pan 2.0 Apply Online

The Government of India, in collaboration with the Income Tax Department, is ushering in a new era of financial transparency with PAN 2.0. This upgraded digital platform revolutionizes the way taxpayers manage their Permanent Account Number, offering enhanced security, faster processing, and a user-friendly online experience.

Also Read: PM Awas Yojana Urban 2.0 Apply Online

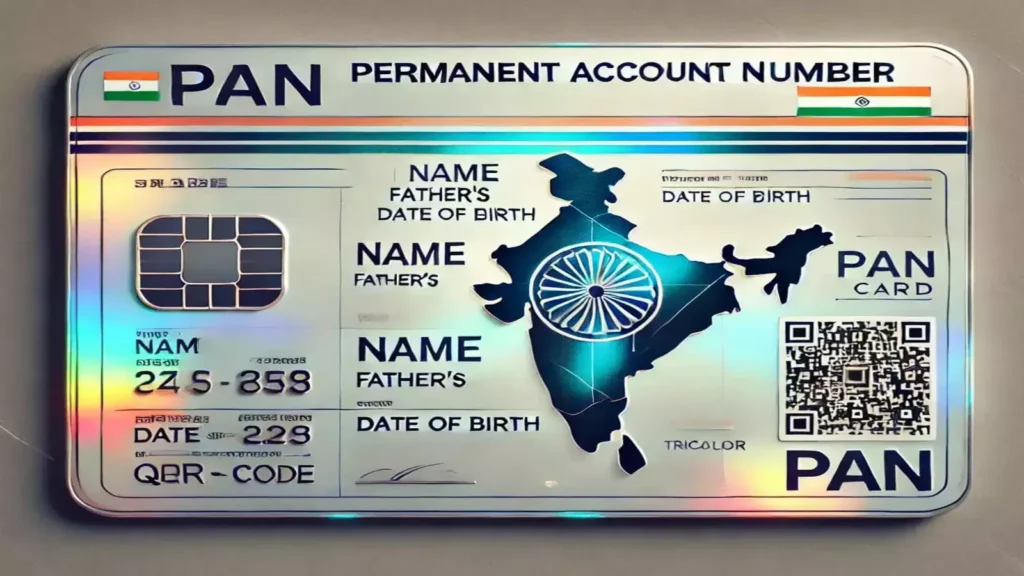

What is PAN Card 2.0?

PAN 2.0 is the next-generation version of the traditional PAN card, designed to meet the demands of a modern digital economy. With integrated QR code verification, advanced encryption, and seamless Aadhaar linking, PAN 2.0 simplifies tax compliance and helps curb fraudulent activities. Whether you need a new PAN or wish to update your existing details, PAN 2.0 makes the process straightforward and efficient.

Key Features and Benefits

- Enhanced Security:

With AI-driven authentication and robust encryption protocols, your sensitive data is safeguarded against unauthorized access. - Instant e-PAN Issuance:

Once your application is processed, you’ll receive a digital copy of your PAN directly via email, eliminating lengthy delays. - QR Code Integration:

The embedded QR code allows for quick, real-time verification, reducing errors and the risk of misuse. - Seamless Digital Integration:

Linking with Aadhaar and other government systems has never been easier, streamlining your financial transactions and tax filings. - Eco-Friendly and Paperless:

The digital format minimizes paperwork, contributing to a more sustainable environment.

Eligibility Criteria for PAN 2.0 in 2025

Before you apply, make sure you meet the following requirements:

- Proof of Identity (PoI):

Submit a valid document such as Aadhaar, Voter ID, Passport, or Driving License. - Proof of Address (PoA):

Provide an official utility bill, gas bill, or any other recognized address proof. - Proof of Date of Birth (DoB):

A birth certificate or another government-approved document is necessary. - For Minors:

A parent or legal guardian must apply on behalf of the minor, providing both their own identification and the child’s birth certificate.

Note: Existing PAN holders do not need to reapply for PAN 2.0. The updated version is automatically available for immediate use.

How to Apply for PAN 2.0 Online: A Step-by-Step Guide

- Visit the Official Portal:

Head to the official UTIITSL or NSDL website to begin your application.(Link Below) - Select the Appropriate Service:

Choose “New PAN” for fresh applications or “Update/Correction” if you need to modify existing details. - Complete the Application Form:

Fill in the required information carefully. Double-check your details to avoid errors. - Verify Your Identity:

An OTP (One-Time Password) will be sent to your registered mobile number or email for quick verification. - Upload Required Documents:

Attach scanned copies of your PoI, PoA, and DoB documents. For minors, include the parent’s or guardian’s ID and the child’s birth certificate. - Submit and Receive Your e-PAN:

After submitting your application, you’ll receive an e-PAN 2.0 Free on your registered email. A physical card is available at a nominal fee, if preferred.

Pan 2.0 Apply Online Link

Transition to a smarter, faster, and more secure PAN experience today. For more details and to begin your application, visit the official PAN portal provided by the Income Tax Department.

| Pan 2.0 Apply By NSDL | Apply Now |

| Pan 2.0 Apply By UTIITSL | Apply Now |

| Join For Latest Update | Telegram | Whatsapp |

Why Upgrade to PAN 2.0?

Embracing PAN 2.0 means stepping into a future of streamlined financial management. The digital process not only reduces the possibility of fraud but also simplifies the management of tax-related tasks through a unified online platform. With real-time updates and instant verification, PAN 2.0 is designed to make tax compliance easier and more secure for every eligible Indian.

Stay ahead with PAN 2.0—the digital solution for all your taxation needs in 2025 and beyond.